What Does Real Estate Reno Nv Mean?

Table of ContentsThe smart Trick of Real Estate Reno Nv That Nobody is DiscussingReal Estate Reno Nv for BeginnersSome Known Incorrect Statements About Real Estate Reno Nv Real Estate Reno Nv - Truths

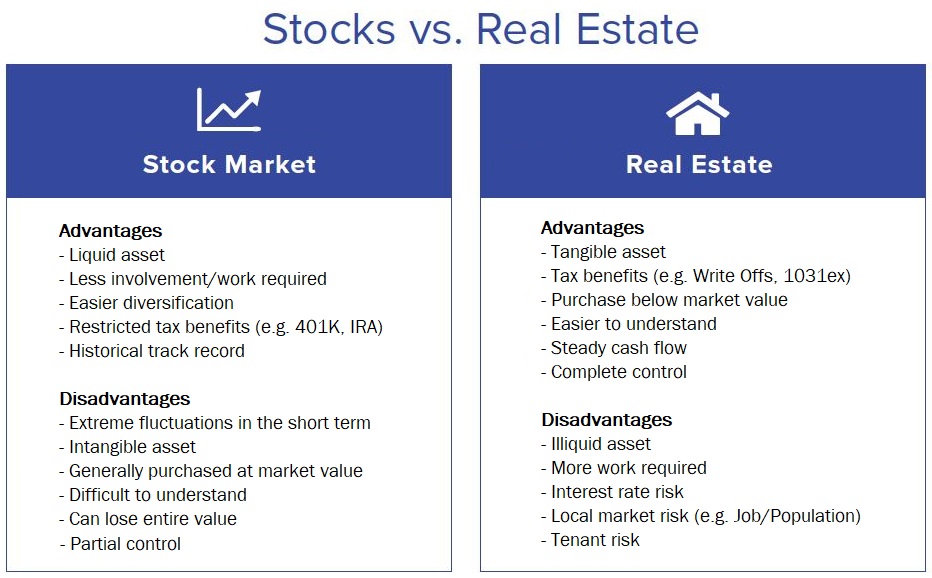

That may show up expensive in a globe where ETFs and common funds may charge as low as zero percent for creating a diversified portfolio of stocks or bonds. While systems might vet their investments, you'll need to do the very same, which implies you'll need the skills to assess the possibility.Like all financial investments, real estate has its pros and disadvantages. Lasting recognition while you live in the residential property Potential hedge against inflation Leveraged returns on your financial investment Easy income from leas or with REITs Tax obligation benefits, consisting of interest deductions, tax-free funding gains and devaluation write-offs Fixed long-term funding offered Appreciation is not guaranteed, especially in economically depressed locations Home costs might drop with greater rate of interest prices A leveraged financial investment means your down payment is at risk May require substantial time and money to manage your own buildings Owe an established home mortgage settlement every month, even if your tenant does not pay you Reduced liquidity for genuine building, and high payments While actual estate does supply several benefits, particularly tax advantages, it doesn't come without significant downsides, in certain, high payments to exit the market.

Or would certainly you prefer to examine deals or investments such as REITs or those on an on-line system? Knowledge and skills While several investors can discover on the work, do you have unique skills that make you better-suited to one kind of investment than one more? The tax obligation advantages on actual estate vary commonly, depending on just how you invest, however spending in actual estate can supply some sizable tax advantages.

What Does Real Estate Reno Nv Do?

REITs offer an appealing tax obligation account you will not sustain any funding gets tax obligations till you market shares, and you can hold shares essentially for years to avoid the tax man. As a matter of fact, you can pass the shares on to your beneficiaries and they won't owe any type of tax obligations on your gains.

Actual estate can be an attractive investment, however capitalists want to make sure to match their kind of investment with their determination and capability to handle it, including time commitments. If you're wanting to produce earnings during retirement, genuine estate investing can be one means to do that.

There are numerous advantages to investing in genuine estate. Regular revenue circulation, strong yields, tax obligation advantages, diversification with appropriate assets, and the capability to leverage wealth via property click to read more are all benefits that financiers may enjoy. Below, we look into the various advantages of buying property in India.

5 Easy Facts About Real Estate Reno Nv Explained

Property often tends to appreciate in value with time, so if you make a smart financial investment, you can profit when it comes time to market. In time, rental fees additionally have a tendency to increase, which may raise capital. Rents boost when economic climates increase because there is even more need for actual estate, which elevates resources values.

Among one of the most attractive resources of easy income is rental profits. One of the simplest approaches to maintain a stable revenue after retired life is to do this. If you are still working, you might increase your rental income by investing it following your monetary purposes. There are various tax benefits to real estate investing.

It will substantially lower taxed earnings while reducing the cost of real estate investing. Tax obligation reductions are offered for a variety of prices, such as firm expenditures, money flow from various other possessions, and home loan interest.

Property's link to the various other major property groups is delicate, sometimes also negative. Realty may for that reason reduce volatility and increase return on danger when it is included in a profile of different properties. Compared to other properties like the securities market, gold, cryptocurrencies, and banks, purchasing property can be substantially much safer.

The smart Trick of Real Estate Reno Nv That Nobody is Discussing

The stock exchange is continually changing. The realty sector has grown over the previous a number of years as an outcome of the implementation of RERA, lowered home mortgage rates of interest, and other aspects. Real Estate Reno NV. The rates of interest on financial institution interest-bearing accounts, on the various other hand, are reduced, especially when compared to the increasing inflation